carolina tax service columbia sc

Crescent Construction is the 1 Roofer in South Carolina. It is a straightforward way to work toward the retirement income you desire.

Employer Self Service Portal SC Works.

. Beginning June 1 2007 an additional sales use and casual excise tax equal to one percent is imposed on amounts taxable pursuant to this chapter except that this additional one percent tax does not apply to amounts taxed pursuant to Section 12-36-920A the tax on. This chapter may be cited as the South Carolina Nonprofit Corporation Act of 1994. According to SCCFF President Karriem Edwards within the past 20 years the organization has impacted 25000 fathers and 56000 children in South Carolina.

Additional sales use and casual excise tax imposed on certain items. The advantages of leaving your money in Deferred Comp upon separation of service or retirement. Search For Jobs Near You.

1952 Code Section 12-760. The South Carolina Deferred Compensation Program Deferred Comp offers a unique opportunity for you to save for your future. COLUMBIA SC With Governor Henry McMaster signing H.

In addition South Carolinas performance-based tax incentives reward companies for job creation and investment. 1-866-831-1724 Relay 711. Employer Tax System ESS.

Visit the Internal Revenue Service at IRSgov or the South Carolina Business One Stop at. The annual Sales Tax holiday weekend in South Carolina is underway. The correct filing fee and any franchise tax license fee or penalty required by this chapter or other law.

Service--we will provide rehabilitation and self-improvement opportunities for inmates. File Pay Apply for a Business Tax Account Upload W2s Get more information on the notice I received Get more information on the appeals process Check my Business Income Tax refund status View South Carolinas Top Delinquent Taxpayers. Payment posting may take 2-4 weeks from January 15th for some mailings and on-site drop box.

1942 Code Section 1226. Columbia South Carolina IRS Taxpayer Assistance Center 803-312-7900 or 1-844-545-5640. Stewardship--we will promote professional excellence fiscal responsibility and self-sufficiency.

3247 into law on Friday May 13 South Carolina is now one of more than three dozen states that exempt military retiree pay from taxation. For any taxpayers property that is assessed by the Department of Revenue and any Fee in Lieu of tax property the Others box needs to be searched using the taxpayers name. The states pro-business policies are demonstrated by the following.

Columbia SC 29214-0850 Phone. You can revoke your consent to receive emails at any time by using the. You are a tax preparer with no SC filing requirement but need to register with the SCDOR to file taxes for your client.

Columbia SC 29223 Monday-Friday 830. SC Department of Commerce 1201 Main Street Suite 1600 Columbia SC 29201 US. Explore free jobseeker and employer resources.

Employer Self Service Portal SC Works. Columbia SC 29201 Phone. The event is designed to give people a break on back to school shopping.

The law is effective beginning tax years after 2021 making military retiree pay 100-percent exempt from state income tax with no earned-income cap. Under South Carolina law tax rate schedules adjust automatically each year based on a formula that considers the. The Official Web Site of the State of South Carolina.

State Income Tax Guidance Information about tax relief and service operations from the South Carolina Department of Revenue. Employer Tax System ESS. Our specialties are commercial roofing residential roofing and general contracting projects.

Explore free jobseeker and employer resources SCWOS. Former Section 33-31-120 1962 Code Section 12-760. The mission of the South Carolina Department of Corrections is.

Safety--we will protect the public our employees and our inmates.

South Carolina Department Of Revenue Facebook

Shiraz Vintage Map Print Shiraz Retro Map Poster Antique Style Map Iran Office Wall Art Housewarming Birthday Gift Vw232

South Carolina Sales Tax Small Business Guide Truic

Business And Other Monetary Subjects If You Have Hired One For Work You Should Know If He Is The Right One Or Not Some Tax Attorney Tax Lawyer Business Law

Pin By Public Safety Collectibles On Modern Police Vehicles Emergency Vehicles Police Patrol Police Cars

Lawmakers To Consider Tax Exemption Expansions For Military Retirees Newsbreak In 2022 Military Installations Across The Border The Expanse

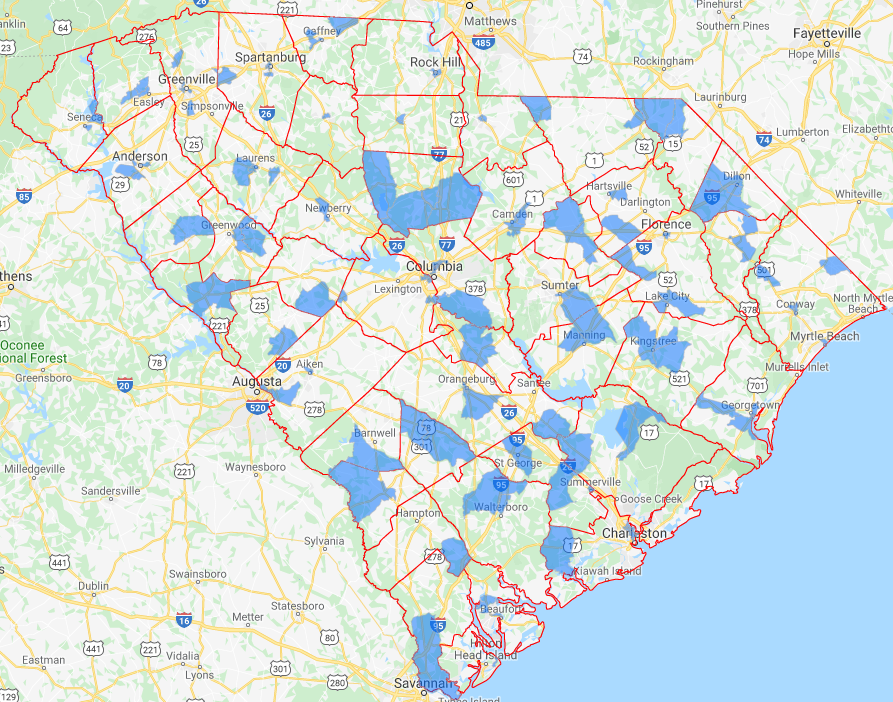

South Carolina Opportunity Zones Commission For Minority Affairs

Small Business Grant Horizon Commercial Leasing Business Grants Opening Your Own Business Small Business

South Carolina Department Of Revenue Facebook

Columbia Marriott King Guest Room Comfort Travel Suite Marriott Hotel Furniture Hotel

Almost Ready New Construction Excellence In The Courts Of Arcadia A Gated Community Close To Forest Acres Sto New House Plans Gated Community New Homes

South Carolina Law Enforcement Division Md 500e Helicopter Helicopter Pilots Helicopter Helicopter Price

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

Need Your Taxes Done Want The Money Back That S Owed To You Call Us Today At Liberty Tax Mobile Notary Notary

Where S My South Carolina Sc State Tax Refund Sc Tax Brackets

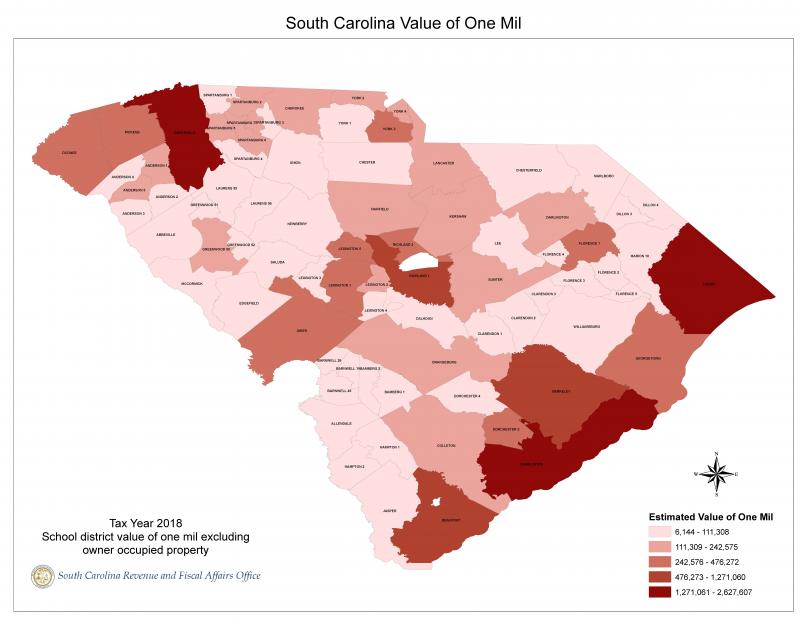

Property Tax Reports South Carolina Revenue And Fiscal Affairs Office